Mobile home financing can be daunting, especially for first-time home buyers unfamiliar with the process, but also for homeowners looking to refinance.

The upside: You might be able to finance a mobile home whether it’s residential real estate or personal property. There are companies that do both. Attic Truss

>Related: Low-Income Mortgage Loans: Low Down Payment, Easy To Qualify

In this article (Skip to…)

Before diving into the specifics of mobile home financing, it’s important to distinguish between mobile homes and manufactured homes, as these terms are frequently used as if they’re the same.

A mobile home refers to a type of prefabricated structure constructed on a permanent chassis that was built before June 15, 1976.

Post-June 15, 1976, a similar type of structure came to be known as a manufactured home. This change was due to the introduction of new safety standards by the U.S. Department of Housing and Urban Development (HUD).

Originally termed “mobile homes” prior to 1976, these are factory-built homes designed with easy mobility in mind. Mobile homes are constructed on a permanently attached chassis with wheels, making them relocatable.

However, they are often placed in a fixed location and can vary in size and design. They were predominantly built before the introduction of the HUD Code, which standardized construction and safety standards.

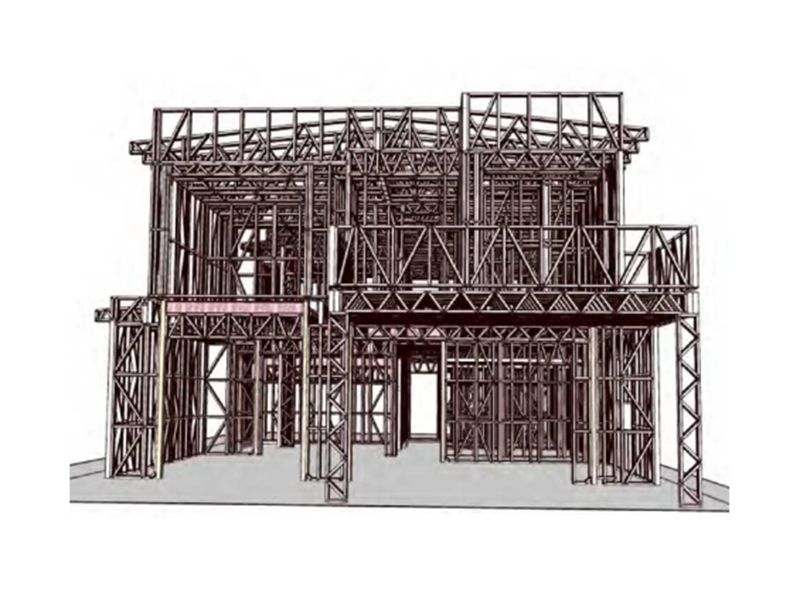

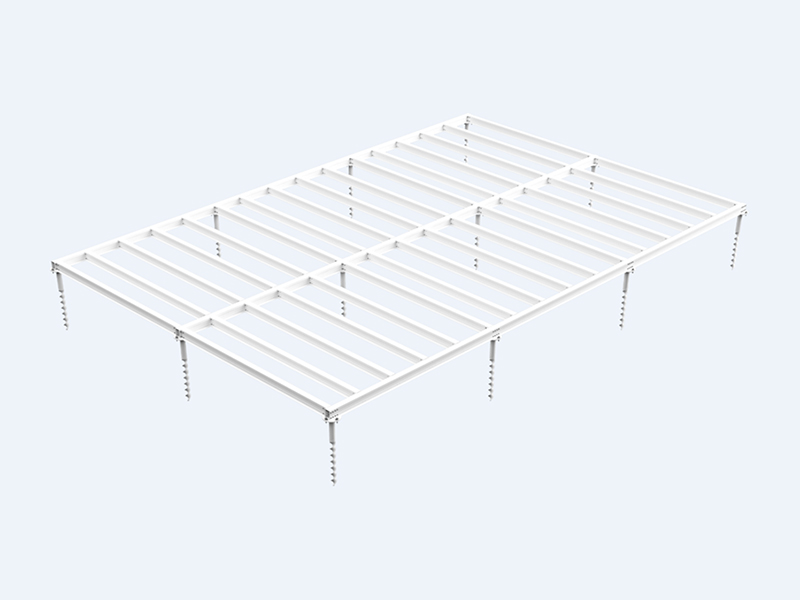

Manufactured homes are the modern evolution of mobile homes. They are built in a factory setting and then transported to their intended site, either on a temporary or permanent foundation.

Manufactured homes are different from their pre-1976 counterparts because of the HUD Code, which guarantees that they adhere to strict safety and construction standards.

For many Americans, mobile home financing represents a flexible and affordable path to homeownership. But mobile homes are, obviously, mobile. So it is possible for a borrower to take a huge residential loan on very favorable terms and then haul the home out of state or even out of the country.

The same is true for cars, and that’s one reason car loans usually come with shorter terms (five years, say, instead of 30) and higher interest rates. It’s also why there is an entire industry built around recovering runaway automobiles.

If you got a mortgage on a mobile home, chances are you wouldn’t stop making monthly payments and disappear from your mobile home park, taking the home with you. But lenders know it is possible.

So lenders differentiate between manufactured homes as real estate and mobile homes that are truly movable.

Typically, it’s easier to get a traditional mortgage on a modular home compared to getting a mobile home loan.

A modular home is built in a factory but delivered in pieces and assembled on site. This type of home is placed on a permanent foundation and often includes a porch or a carport.

A manufactured home is a mobile home built after 1976 that has HUD tags to show its compliance with modern codes.

It is possible to get a traditional mortgage loan, such as an FHA loan or a USDA loan, on a manufactured home.

But keep in mind that manufactured houses tend to depreciate, or lose value, as they age. This also makes lenders less likely to approve loans with competitive mortgage rates for these types of homes.

However, in areas where more people own manufactured homes, it’s generally easier to find better mobile home financing. The darker areas in the map above indicate areas with a higher percentage of manufactured or mobile units.

Mobile home financing and refinancing can be very different from financing a traditional home. This is because most lenders don’t classify these homes as eligible for traditional mortgage loans.

Even so, there are specialty lenders that offer financing for manufactured homes, provided they meet distinct criteria and are situated on a permanent foundation.

In this section, we will go over the various mobile home financing options available to help you reach your homeownership goals.

The Federal Housing Administration (FHA) guarantees FHA loans. This government backing allows borrowers with lower credit scores to buy single-family homes.

In addition to FHA loans, HUD also offers two types of mobile home financing through the FHA. These include both Title I and Title II loan programs, each catering to different types of home buyers.

Under the Title I program, borrowers can secure financing for a new or pre-owned manufactured home, refinancing an existing mobile home, purchasing the land for placing a manufactured home, or a combined loan for both the home and the land.

Additionally, these loans can be used for modifications, repairs, or enhancements to a manufactured home.

A unique aspect of the Title I loan is that it’s available even if the borrower doesn’t own or isn’t purchasing the land where the home will be located, such as in a mobile home community or park. In these cases, the borrower must have a lease for the plot with a minimum duration of three years.

The terms of these loans also include specific caps on the amount that can be borrowed:

The loan terms vary based on the type of purchase:

The Title II loan program is designed for those looking to finance a manufactured home along with the land, provided the property meets certain criteria. Notably, this loan is intended for individuals who will use the manufactured home as their primary residence, not for real estate investment purposes.

To be eligible, the home must:

Title II loans are not applicable for homes on leased land in mobile home parks or communities. The down payment for these loans can be as low as 3.5%, and the repayment period can extend to 30 years.

Typically, conventional loans aren’t available for mobile or manufactured homes, as these are often not classified as real estate. However, there are some exceptions for well-known mortgage entities such as Freddie Mac and Fannie Mae, which have specific loan programs for manufactured homes.

Fannie Mae offers the MH Advantage program through select lenders. This program is tailored for those seeking to purchase manufactured homes, offering up to 30-year loan terms with down payments starting as low as 3%.

To be eligible, the home must meet certain requirements: it needs to be at least 12 feet in width, have a minimum living space of 600 square feet, and it cannot be located on leased land.

Freddie Mac offers traditional mortgages for manufactured homes as well, as long as the properties meet their requirements. These homes must be built on a permanent chassis, recognized as real property, and feature at least 400 square feet of living space.

It’s important to note that while not all lenders offer mobile home financing or manufactured home loans, both Fannie Mae and Freddie Mac do provide options for properties that meet their specific qualifications.

The Department of Veterans Affairs provides VA loans to veterans and eligible active-duty service members so they can buy manufactured homes and the land they are situated on. These loans come with several advantages, such as the possibility of a zero-down payment and exemption from mortgage insurance.

A manufactured home needs to fulfill certain requirements in order to qualify for a VA loan.

Should your property fail to satisfy these requirements, you will not be qualified for VA mobile home financing.

Chattel loans offer a unique financing option for purchasing mobile homes. Classified as personal property loans, they are primarily used for acquiring high-value items like aircraft, boats, farm equipment, and, notably, mobile homes. The important thing about these loans is that the new home is used as collateral.

Chattel loans are especially beneficial for people who do not own the land on which their mobile home will be placed, such as a mobile home park.

Mobile homes are often more affordable than traditional homes, which makes personal loans a viable option for mobile home financing. However, they usually have higher interest rates than mortgages or auto loans.

A key benefit of personal loans is that they don’t require collateral, so your home isn’t at risk if you struggle with repayments. Plus, applying for a personal loan tends to be simpler, faster, and involves fewer documents than other types of loans.

Mobile home financing may appear complicated at first, but it is actually rather simple once you break it down into smaller, more manageable steps.

Begin by taking stock of your financial situation. Determine your debt-to-income ratio, check your credit score, and take your income stability into account. Knowing your financial situation is essential to figuring out what kind of loan you might be eligible for and how to get ready for the application process.

Your next step is to decide on the type of mobile home that fits your lifestyle and budget. Whether it’s a mobile, manufactured, or modular home, each category has specific financing routes. This choice is pivotal, as it directly impacts the loan options available to you.

Take time to research and compare various financial institutions, focusing on their loan terms, mortgage rates, and down payment requirements, as well as the home purchase price they’re willing to finance. Prioritize lenders specializing in mobile home financing, as they often offer competitive rates and more personalized service.

These lenders might also provide a choice between adjustable-rate and fixed-rate mortgages, allowing you to select an option that best aligns with your financial situation and long-term goals.

Prepare for the loan application process by collecting all necessary documentation. This includes proof of income, employment details, a credit history, and specifics about the mobile home you plan to buy.

Organizing these documents in advance can expedite the loan application and increase your chances of approval.

With your research and documents in hand, it’s time to begin the loan application process. Ensure accuracy in your loan application to avoid any delays. Stay proactive in communicating with your lender throughout the process to address any issues promptly and keep track of your application’s status.

Homeowners may not always care whether their manufactured home qualifies as real estate or falls into the category of a vehicle. But lenders care if you’re trying to finance a home.

To be a house and not a car, your manufactured home must pass a few tests, HUD says:

These are not all the criteria. Here’s a link to the whole set of guidelines. Alternatively, have a licensed appraiser assess and value the property.

If you pay annual taxes to your state Department of Motor Vehicles, you definitely have a vehicle. However, you can convert a manufactured home into real property by following the guidelines listed in the link above.

Manufactured homes must have “HUD tags” to meet most mortgage lending guidelines. These tags, or more properly, “certifications,” state that the manufacturer complies with safety standards created by the U.S. Department of Housing and Urban Development, or HUD. A HUD tag shows the home meets safety and livability standards, so it’s a good thing to have.

This rule became law on June 15, 1976. HUD notes that while it is the only agency with this requirement, most lenders also follow its guidelines. Prior to the 1976 rule, manufactured housing was prone to safety problems like electrical and wiring issues that caused home fires.

Buying a pre-1976 mobile home might not be the best choice due to safety concerns. Mobile homes from this era often have heating and cooking equipment near sleeping areas, increasing fire risks and limiting escape routes. The National Fire Protection Agency notes that mobile homes built to post-1976 HUD standards have significantly lower fire-related risks, thanks to government-imposed safety requirements.

Lenders and loan programs have specific rules about financing a manufactured home. If the home meets HUD and local codes and is permanently located on a parcel of land, it could be possible to get financing through a mortgage lender. If the home doesn’t meet all the requirements, you may need a personal loan, a chattel loan, or a special FHA Title I loan.

It’s best to have a credit score of at least 580 before applying for manufactured home financing. Borrowers with credit scores of 620 or higher have more loan options. Personal loans may require higher scores since they’re not secured or insured.

Yes, it is possible to finance a modular home over 30 years if the home meets the lender and loan program’s requirements.

Traditional mortgages require closing costs which could range from about 2-5 percent of your loan amount. A personal loan typically charges an upfront origination fee. This fee could range from 1-6 percent of the loan size.

Homeownership comes in many forms. While a manufactured home likely won’t appreciate as an investment, owning one has benefits over renting.

Two Bedroom Modular Homes Buying or refinancing a manufactured home can be tough. But look around for mortgage options like FHA, and non-mortgage solutions like personal loans.